Admin

February 1, 2021

UK utilities cut out the middleman for improved pollution performance

As England and Wales’ water regulators push ever more ambitious performance targets in the wake of high-profile failures, what does the most recent regulation shift mean for utilities and technology providers in one of Europe’s most consolidated water markets?

If you only have one minute…

Despite reporting consistent downward trends in water pollution in recent years — an achievement made all the more remarkable when considering increases in population and productivity have coincided with significant advances in monitoring techniques — England and Wales’ water utilities are targeting still greater improvement.

Price regulator Ofwat’s 2019 price review and the start of a new asset management period (AMP7) have ushered in significant changes to performance goals, incentives, and supply chain structures, with some utilities targeting an 80% reduction in environmental pollution to 2025.

After issuing record breaking fines for ‘shocking’ breaches in wastewater discharge limits, the regulator’s new guidelines have been structured to reward the agile development and deployment of solutions that simultaneously promote efficiency and protect the environment.

Now more than ever, utilities are being encouraged to work with solutions providers directly to solve the persistent problems that previous supply chain models have failed to resolve.

The way is open for utilities to work with specialist solution providers directly to solve specific problems, no matter the scale, maximizing efficiency and encouraging innovation.

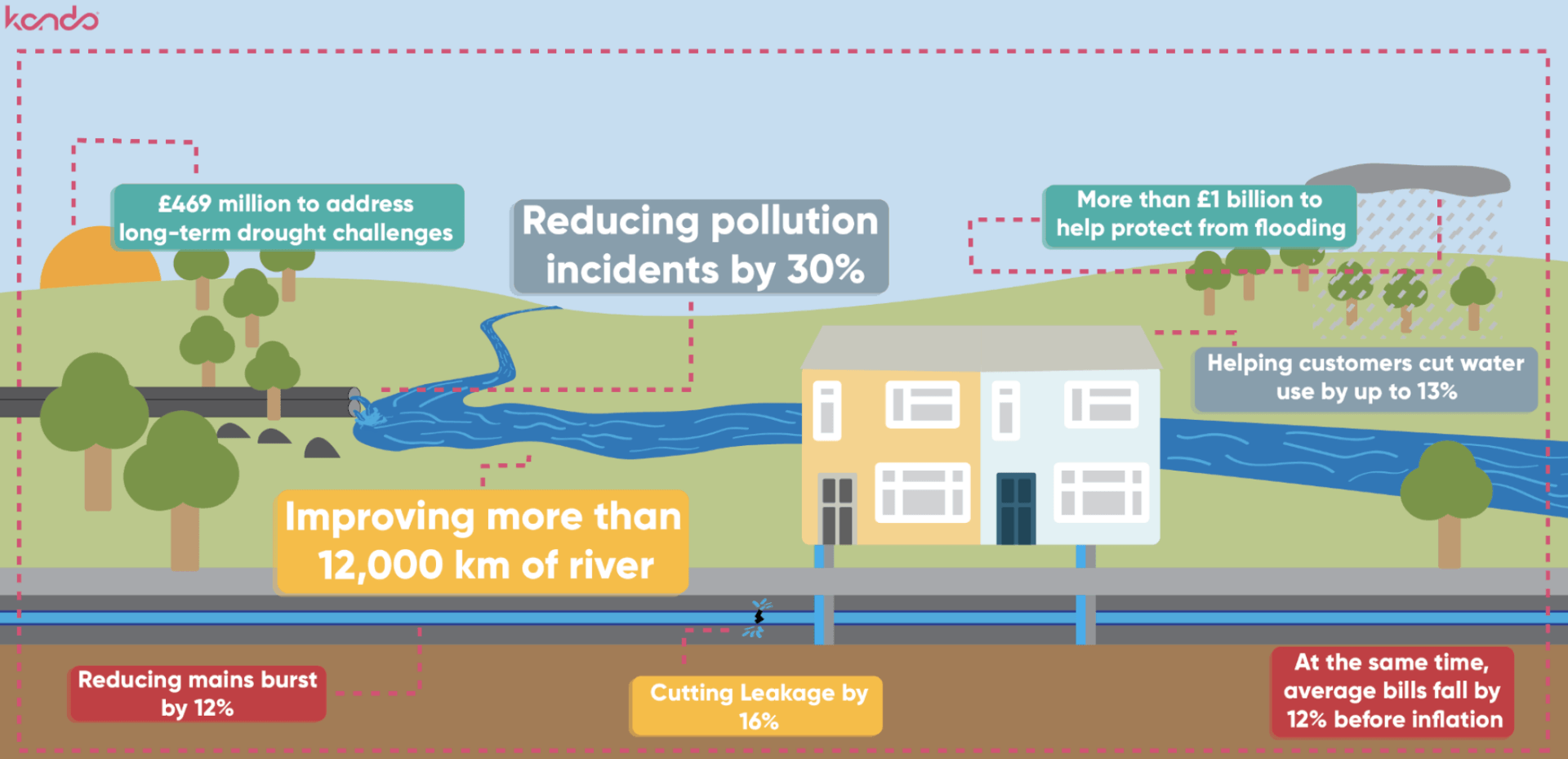

Figure 1, Ofwat’s 2019 price review final determination outlines a five-year package worth £51 billion as England and Wales’ water and wastewater utilities work to meet more stringent regluatory targets

If you have a few more minutes…

Regulators drive improvements

Despite being largely privatised, it is regulation and not competition that drive improvement and adaptation in England and Wales’ water and wastewater sector.

Through the 1980s, reduced public spending and increased operational costs opened a significant funding gap in the sector — a gap it was proposed private finance could bridge far more readily than could the public purse.

The plan worked, and the six years following the 1989 creation of 11 new water and wastewater service providers across England and Wales (ten of which would be privately owned) saw an 83% increase in investment compared to the six years prior to the change (up from £9.3 billion to £17 billion).

While stabilising the sector’s finances, the move created large natural monopolies, with geography determining which company would service which customers. As a result, a comprehensive regulatory structure was introduced to mitigate any vulnerability to exploitation.

With potable water overseen by the Drinking Water Inspectorate, the Environment Agency (EA) was created to regulate discharge permits and determine wastewater standards, and prosecute utilities failing to comply. Ofwat, the price regulator, exists to control billing and service standards, rewarding the best performers and encouraging a system of ‘comparative competition’.

A five-year regulation cycle

Without the pressure of regular market competition to encourage improvement, a five-year cycle of regulatory review was implemented to avoid stagnation.

There are two major sets of guidelines published on this five-year schedule, with the most recent changes coming in 2019 and 2020. Asset Management Periods (AMP) are proceeded by Price Reviews (PR), with PR19’s final determinations having been published in December 2019 followed by the advent of AMP7 in April 2020.

In its most recent review, Ofwat determine key service features for utilities to achieve, including non-revenue water and wastewater discharge targets. The goals outlined in each price review are based on the achievements and failures of the previous AMP, and any policy targets deemed necessary by the government.

Wastewater discharge failings and Southern Water

In the period preceding AMP7, no failure was greater than that of Southern Water.

In 2019 it emerged that, between 2010 and 2017, Southern Water — the water and wastewater service provider for more than 4.5 million people in the south of England — had been guilty of ‘shocking’ breaches in wastewater discharge regulations.

The subsequent Ofwat investigation found that Southern had manipulated its wastewater sampling processes, allowing it to misreport and exaggerate the performance of a number of its treatment facilities. Given the utility had already been found guilty of similar coverups in 2007, the penalties were significant. In addition to a £3 million fine payable to the government, £123 million was to be refunded to customers.

While Ofwat was unable to quantify the full extent of Southern’s infringements, the regulator stated that the utility’s misreporting resulted in ‘many thousands of hours’ of wastewater spills going unacknowledged. Even if only a fraction constituted environmentally damaging pollution events, the negative impact was intolerable.

Regulation, reform, and innovation

Following this episode, Ofwat’s PR19 included significant incentives for utilities to innovate their regulation, operation, and monitoring processes, with wastewater management and pollution reduction central to their goals. The steps proposed included performance related reward structures and a significant innovation fund.

The review outlined that the seven best performing companies based on certain performance indicators (including reduced internal sewer flooding and pollution incidents) would receive ‘enhanced outcome delivery incentive’ rates. To qualify, utilities would have to perform better than the best performers during the previous AMP (AMP6) and share their successful innovations with the other companies.

To support this, Ofwat is making £200 million available through an innovation competition, ‘to encourage companies to collaborate with each other and with other companies in their supply chains.’

Following PR19, the final determination for AMP7 permits utilities to spend up to £51 billion to achieve some significant performance improvements, including red ucing water pollution by 30% and improving the condition of 12,000km of rivers (see Figure 1).

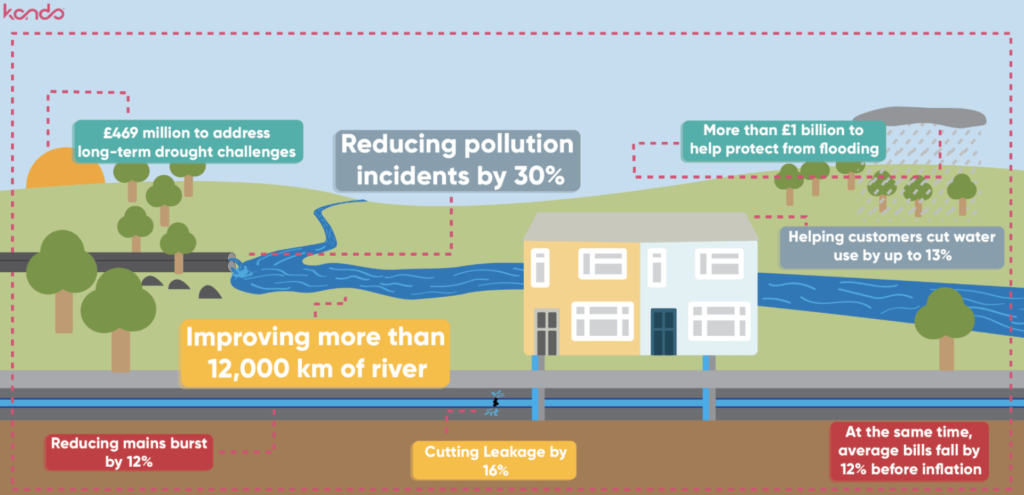

A summery of the key targets England and Wales’ major water and sewerage companies have agreed to during AMP 7

Figure 2, A summery of the key targets England and Wales’ major water and sewerage companies have agreed to during AMP 7

Reforging the supply chain

Achieving these targets while simultaneously cutting household bills by £50 — another key target — will be a huge challenge, but water companies are not alone in their efforts.

The supply chain’s role will be critical in helping water companies deliver on their plans, and AMP7 comes hand in hand with some significant structural changes.

“Up to now, a typical arrangement would have seen a utility entering into a framework agreement with a ‘tier one’ contractor. The contractor — normally a firm such as Mott MacDonald or Black & Veatch — would then oversee the utility’s capital investment programme for the duration of the AMP,” Sébastien Mouret, Global Water Intelligence’s Europe editor observes. “In AMP7 this has shifted. Now the utilities are encouraged to get more involved in the subcontracting themselves and to seek out specific partners at the tier two and three level to respond to specific needs.”

By forging a more direct link between the utilities’ needs and those working to fulfil them, the intention is to drive innovation and optimise efficiencies through closer ties and more effective communications.

AMP7: An opportunity for specialists and marginal gains

Even prior to the most recent regulation targets, England and Wales’ water companies had already reduced pollution levels to their lowest rates on record. Given this has been achieved despite the country’s notoriously ageing infrastructure, an ever-expanding population, and improvements in event detection and reporting, this is no small feat.

Further improvements, especially on the scale targeted during AMP7, will require marginal gains across a number of targeted disciplines. Data-guided automation and operational insights will be central to achieving this and, as has been demonstrated in other sectors — health & safety, for example — solutions that enable incident prevention offer particularly high returns.

The stage is set for small but specialised solutions providers to work with utilities to set new standards for efficiency and achievement in the sector. All that’s required is for utilities to understand their needs and find the right solutions to achieve their goals.

Your wastewater contains the data.

We just need to extract it so that you can optimize your operations.

Contact us and a member of our team will get back to you as soon as possible.